Member-only story

The Incredible Wealth Gap

The intergenerational wealth gap is big, but it’s nothing compared to the division between the “Haves” and the “Have-nots”

Many people have differing perspectives on what makes life challenging. For Baby Boomers (those born between 1946 and 1964), it was the thought of being drafted right out of high school and sent to die in a swamp in Vietnam. For Generation Xers (those born between 1965 and 1980), it was the idea of having to raise their kids and take care of their aging parents, all at the same time. For Millennials (born between 1981 and 1998), considerations of living without any wealth drive them crazy. The idea of being unable to have a “normal life” is what plagues many young adults these days, who wonder what it was like for previous generations as they aged.

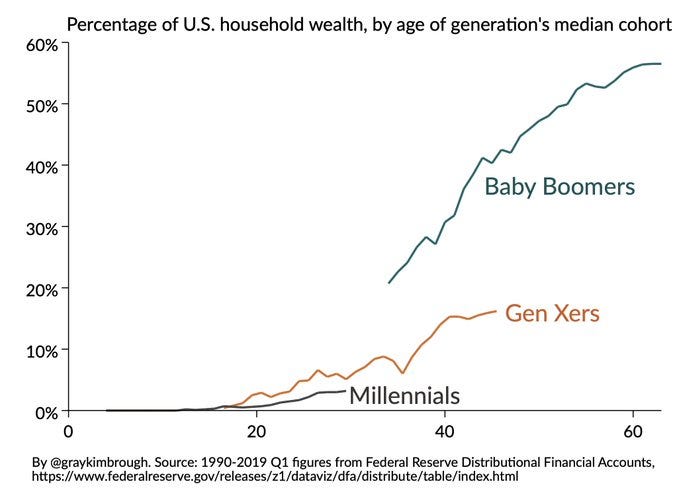

An economist named Gray Kimbrough recently calculated the ownership of wealth by generational cohort’s median age — 35 years old — and then compared how much wealth generations owned at that age.

Wealth is what you own, minus what you owe. Houses’ values, minus the mortgages; automobiles minus the auto loans; whatever else you own, minus the debts. In total, wealth is your net worth, and it’s a big deal because it pertains to a family’s sense of security; and a country’s economic strength in the community of nations.

Acquiring wealth is tied into certain important events adults experience: buying your home, building a business, paying for a child’s education, and retiring comfortably.

As the chart above shows, Baby Boomers collectively owned 21 percent of the nation’s wealth by the time their generation hit the median age of 35 in 1990.

Generation X came of age when the era of wage stagnation and growing inequality arose in the 1970s and ’80s. When a typical Gen Xer reached 35 in 2008, his or her share of the nation’s wealth was just 9 percent, less than half that of Boomers when they reached 35.

Millennials haven’t reached the age-35 mark yet — that won’t happen until about three years from now — but their financial situation is relatively dire. They own just 3.2 percent of the nation’s wealth. To catch up to Gen Xers, they’d need to triple their wealth in just three years. To reach…